York BID warns hospitality sector faces ‘disastrous blow’ as rateable values soar by 41%

York BID is warning that the city’s hospitality sector faces a potentially disastrous financial shock after new analysis revealed sharp increases in rateable values following the Valuation Office Agency’s latest revaluation. Rateable values determine the business rates a property pays, so increases lead directly to higher costs.

York BID carried out the analysis following growing concern from York businesses, many of which contacted the BID after receiving early indications of significant increases to their rateable values. In response, York BID undertook a study across its geographic area ahead of the new business rates taking effect from April 2026.

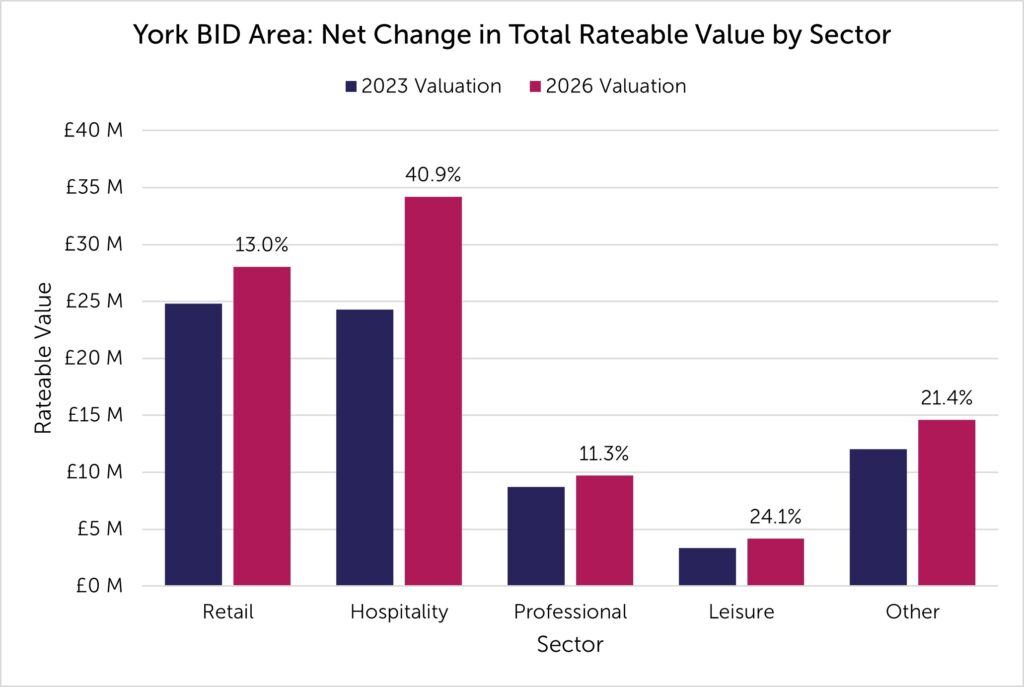

Nationally, rateable values are estimated to rise by an average of 19.2% across England and Wales. However, York BID’s findings show the impact on York city centre will be uneven.

The hospitality sector is expected to be hit hardest, with rateable values rising by a combined £10 million across 331 businesses – a 41% increase compared to the 2023 valuation set during the COVID-19 pandemic. The table below shows the net change in rateable value in York city centre by sector.

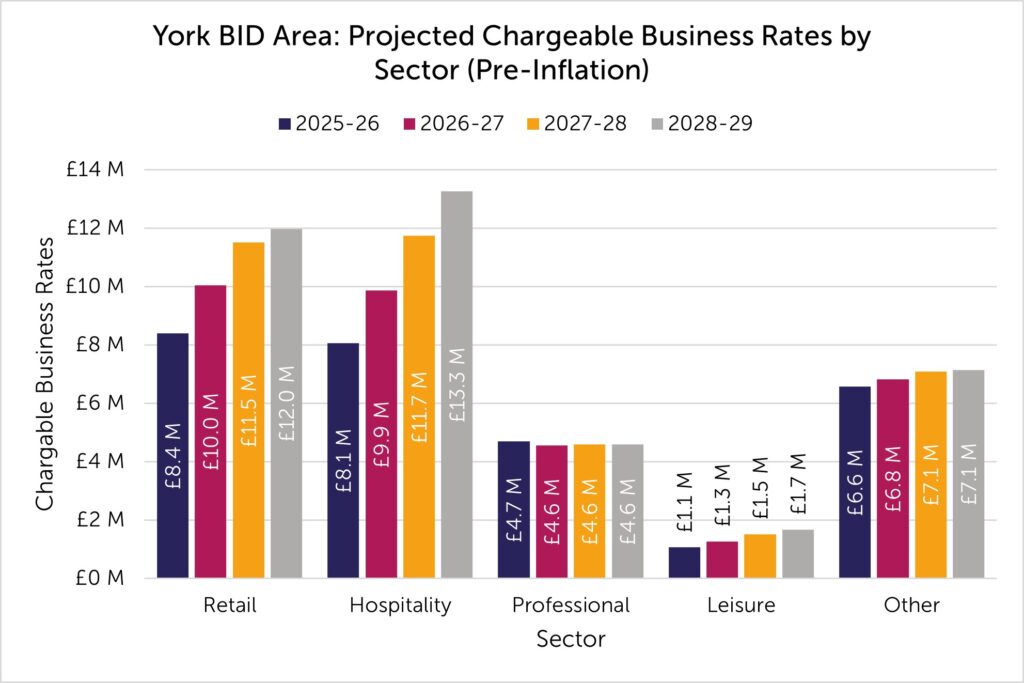

Despite commitments in the Labour Party’s manifesto to reform business rates and level the playing field between the high street and online giants, York BID’s analysis suggests hospitality businesses risk bearing a disproportionate burden. The sector faces an estimated £1.8 million increase in business rates liabilities next year alone – a 23% rise on the current financial year (2025/26) – with further £3.4 million of increases expected in subsequent years (pre-inflation).

Hospitality is central to York’s city centre economy, accounting for around 34% of businesses within the York BID area. The food and drink sector alone employs approximately 17,000 people and accounts for around 37% of local consumer spending.

Commenting on the findings, Andrew Lowson, Executive Director of York BID, said: “We were contacted by a growing number of city-centre businesses who were extremely worried about what the revaluation could mean for them. A 41% increase in rateable value is not a marginal adjustment – it represents a step-change in costs for a sector already under intense pressure. Without meaningful intervention or transitional support, these changes risk undermining business viability, jobs, and the vibrancy of the city centre.”

These increases come alongside further cost pressures, including another rise in the National Living Wage and the potential introduction of a tourism tax. Many hospitality businesses say the cumulative pace of change is becoming unmanageable.

Paul Gardner, owner of The Terrace Sports Bar & Kitchen in York city centre, said: “We feel completely let down by the government’s approach to independent pubs. The 2026 revaluation is a disastrous blow – my rateable value is set to more than double. This isn’t just a rate rise, it’s a monumental increase that will inflate every cost we face, from our Sky subscription to our licensing fees. Why are small, independent businesses being hammered when highly profitable supermarket chains are barely touched? This unfair weighting against hospitality jeopardises not only our short-term profitability but our ability to keep the doors open for the long term.”

Anonymous example of impact of business rates change

A typical Pub in York city centre with a rateable value of £29,000 is currently paying an annual business rates bill of £8,683. Under the 2026 revaluation, their rateable value has increased to £45,000, and under the new rules, in 3 years’ time their business rates bill will have increased by 97% to £17,190 (plus inflation).